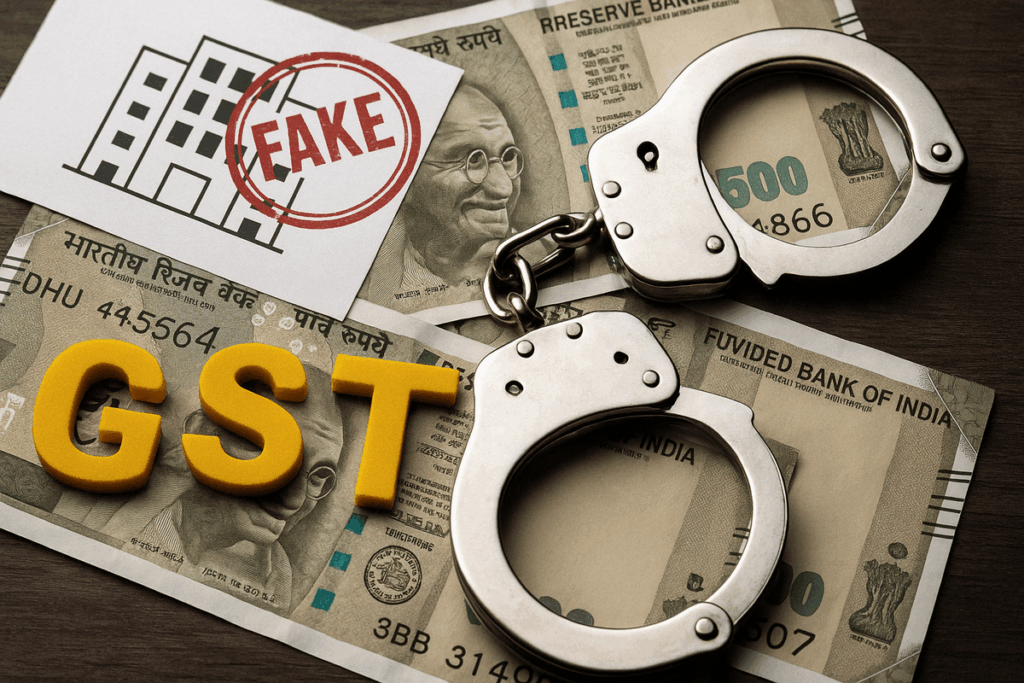

Central and state GST officers have uncovered 25,009 fake firms involved in fraudulently passing input tax credit (ITC) worth Rs 61,545 crore during the 2024-25 fiscal year. Authorities managed to recover Rs 1,924 crore and arrested 168 individuals in connection with the fraud. The government is tightening the GST registration process and implementing measures to track the masterminds and recover dues.

In a significant crackdown on tax fraud, Central and state Goods and Services Tax (GST) officers have uncovered 25,009 fake firms involved in fraudulently passing input tax credit (ITC) worth ₹61,545 crore during the 2024-25 fiscal year. The authorities have also managed to recover ₹1,924 crore by blocking ITC and have arrested 168 individuals in connection with the fraud.

The detection of these fake firms, which were primarily engaged in generating and passing fake ITC, comes as part of the government’s ongoing efforts to curb tax evasion and enforce stricter compliance under the GST regime. The fraud occurred across multiple sectors, with a number of fake entities allegedly involved in manipulating invoices to gain unauthorized tax credits.

The officers’ efforts to combat this issue were intensified through a series of raids and audits conducted throughout the fiscal year. The crackdown resulted in the recovery of ₹1,924 crore, which had been fraudulently claimed by these fake companies. Additionally, the government has started tightening the GST registration process, making it harder for such fraudulent firms to operate undetected. Measures are also in place to track down the masterminds behind these illegal operations and ensure that they are brought to justice.

The detection of such a large-scale fraud highlights the challenges that the Indian tax authorities face in curbing illegal practices under the GST framework. The government is taking steps to strengthen its monitoring systems, enhance the capabilities of its officers, and bring about greater transparency to ensure that GST collections are not compromised by unscrupulous entities.

Authorities have vowed to continue their efforts in rooting out tax evasion, with further investigations underway into the scope of the fraud and the individuals involved. In light of the growing number of fake firms being discovered, additional reforms are expected to streamline the GST registration process and ensure stricter verification of entities seeking to register under the system.

As India works to tighten its tax systems and improve compliance, the action against the fake firms is a clear indication that the authorities are determined to protect the integrity of the GST framework and recover the government’s dues from fraudulent claims.