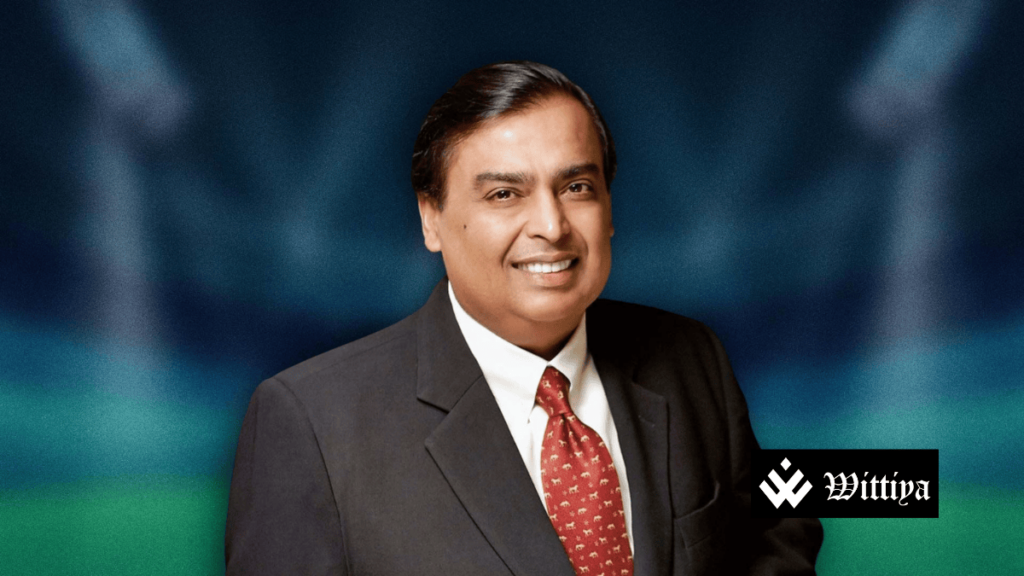

Mukesh Ambani, India’s richest tycoon and chairman of Reliance Industries Ltd., faces major risks to his $50 billion investments in retail and digital services due to increasing US-India trade tensions. Potential regulatory shifts, competition from Elon Musk’s Starlink, and oil import challenges could significantly impact Reliance’s valuation. As American interests push for policy changes, Ambani’s market dominance in India might face unprecedented threats.

Mukesh Ambani, chairman of Reliance Industries Ltd., India’s largest conglomerate based in Mumbai, Maharashtra, faces mounting challenges as increasing US-India trade tensions threaten his $50 billion investments in retail and digital services. Reliance, a diversified corporation operating in energy, telecom, and retail, has long benefited from India’s protectionist policies. However, the possibility of regulatory changes driven by US interests and heightened competition from American players like Elon Musk’s Starlink now pose significant risks.

Reliance Retail, India’s largest retailer with over 19,000 stores and multiple e-commerce platforms, has enjoyed a favorable regulatory environment that restricts foreign competitors from carrying their own inventory or offering deep discounts. This protection has kept American giants like Amazon and Walmart’s Flipkart from directly challenging Reliance’s dominance. However, as the US pushes for policy changes in trade negotiations, Ambani could see key advantages erode.

Another major challenge comes from Elon Musk’s Starlink, which aims to disrupt India’s telecom market. Reliance Jio, India’s largest mobile network operator, has transformed the country’s digital landscape with low-cost internet services. Starlink’s satellite-based internet could challenge Jio’s dominance, especially in rural India, where Jio has heavily invested. If policy shifts allow Starlink more room to operate, Jio’s stronghold on digital services could weaken.

Reliance’s energy segment is also facing global uncertainties. The company depends on oil imports, particularly from the Middle East, which could be impacted by geopolitical tensions and new US policies. Rising crude oil prices or supply restrictions could affect Reliance’s refining business, further pressuring its overall valuation.

With former US President Donald Trump’s influence over trade policies and growing American competition in India’s tech and retail sectors, Ambani’s empire is at a critical juncture. Any concessions India makes in ongoing trade discussions could reshape the competitive landscape, making it harder for Reliance to maintain its dominant position.

While Ambani has successfully navigated challenges in the past, the coming months will test his ability to defend Reliance’s market supremacy in an evolving global economic environment.