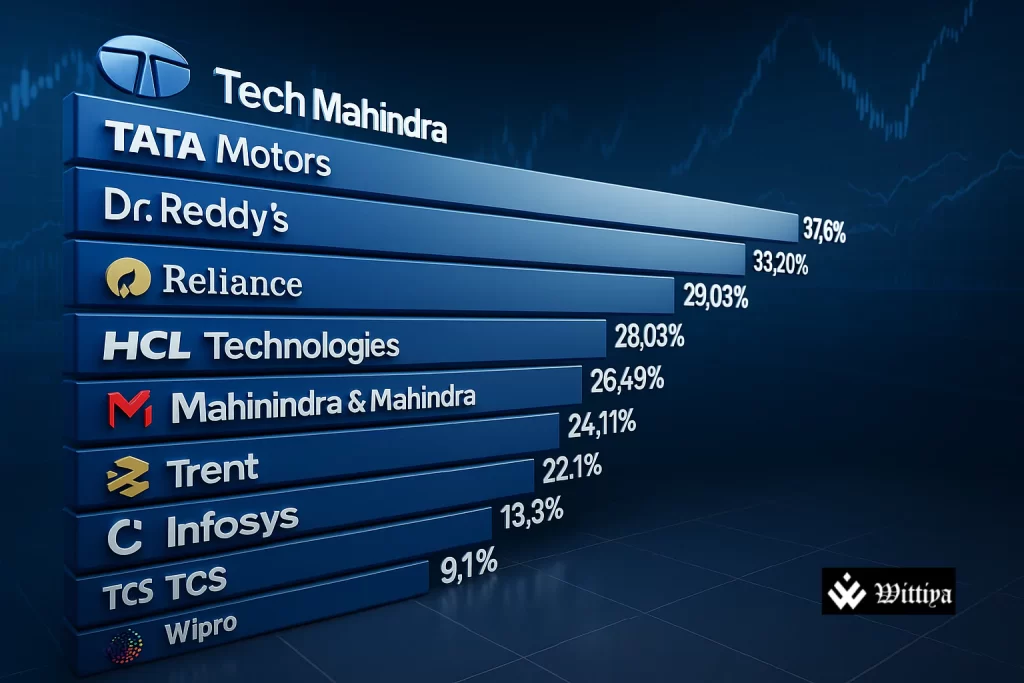

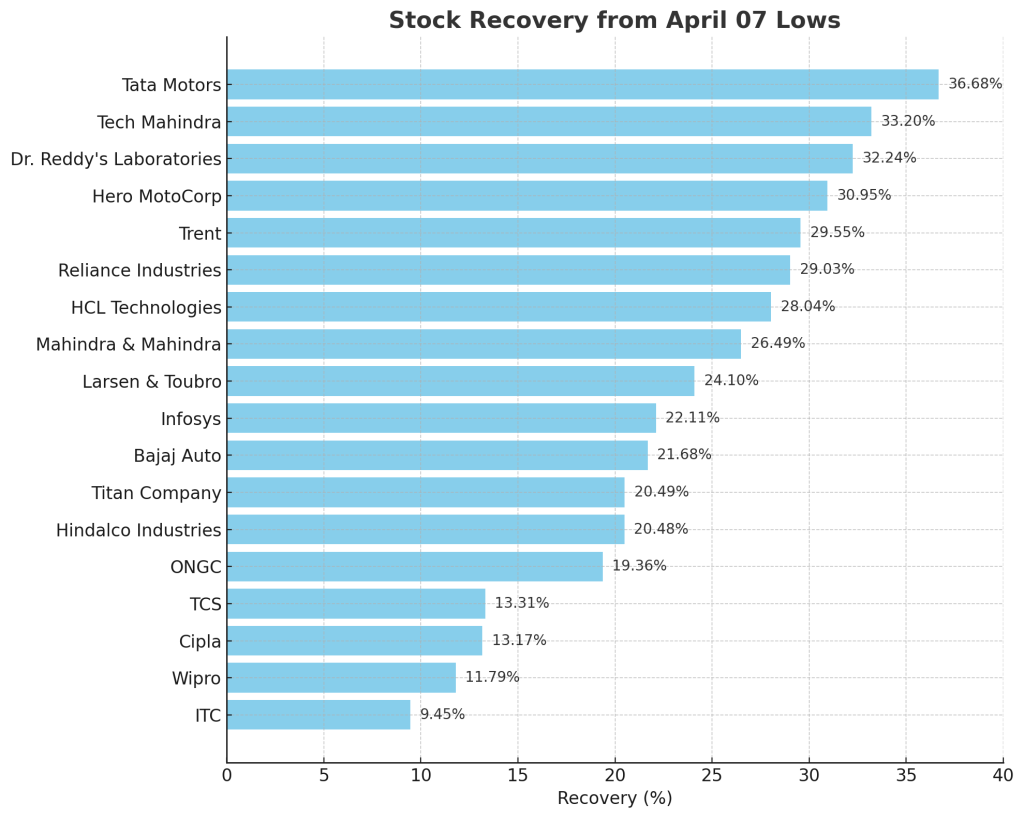

India’s stock market has seen a notable recovery with 18 Nifty 50 stocks rebounding sharply from their April 7 lows, led by Tata Motors, which surged nearly 37%. Backed by favorable global trade cues, domestic economic indicators, and renewed foreign investor interest, sectors like auto, pharma, and tech have posted strong gains. Major companies from the Tata Group, such as Trent, Titan, and TCS, contributed to the momentum alongside Reliance Industries and several tech firms.

The Indian stock market has witnessed a sharp rebound, with 18 Nifty 50 stocks surging significantly from their April 7 lows. Leading the rally is Tata Motors, which has soared by 36.7%, reflecting renewed investor confidence and strong domestic and global cues.

The upward momentum has been fueled by favorable developments such as easing global trade tensions, return of foreign portfolio investors, and domestic indicators like stronger-than-expected Q4 GDP growth, early monsoon, and improved liquidity conditions. The long-anticipated India–UK free trade agreement and positive sentiment around a potential India–US trade deal have also added to market optimism.

The Tata Group has emerged as a key contributor to the market’s strength. Apart from Tata Motors, Trent, Titan Company, and TCS recorded gains of 30%, 20.5%, and 13.31%, respectively.

In the auto sector, Hero MotoCorp, Mahindra & Mahindra, and Bajaj Auto rose by 31%, 26.49%, and 22%.

The pharma sector also saw notable gains, with Dr. Reddy’s Laboratories and Cipla climbing 32.24% and 13%.

Technology stocks rebounded sharply, as Tech Mahindra jumped 32.2%, HCL Technologies advanced 28%, while Infosys and Wipro posted gains of 22.11% and 12%.

In addition, Reliance Industries, one of India’s largest conglomerates, also contributed to the rally with improved performance and investor sentiment.

Although concerns around sectoral valuations persist, the current fiscal’s projected earnings recovery and consistent domestic buying continue to support the market’s momentum. However, the sustainability of this rally will depend on future global trade outcomes and earnings performance across sectors.