Indian stock markets soared by over 2.5% on May 12 following a ceasefire agreement between India and Pakistan, bringing relief after four days of escalating conflict. The Nifty 50 and BSE Sensex rallied alongside mid- and small-cap indices, signaling renewed investor confidence. Financials, IT, and tourism sectors led the rally, while pharma stocks dipped due to U.S. policy concerns

On May 12, Indian stock markets witnessed a sharp rally as the country’s ceasefire agreement with Pakistan provided relief to investors after days of military tension. The truce followed a four-day exchange of strikes, the most intense in nearly 30 years, that had dampened market sentiment.

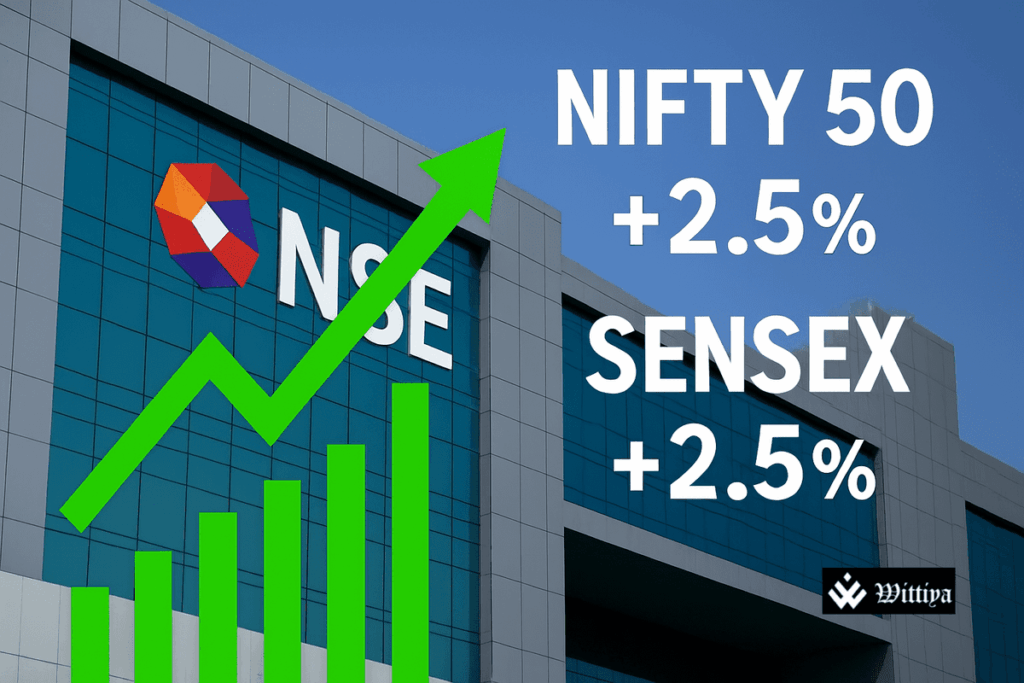

The National Stock Exchange of India (NSE), a leading financial exchange headquartered in Mumbai, Maharashtra, reported that the benchmark Nifty 50 index surged 2.5% to 24,700.05 by 10:15 a.m. IST. Simultaneously, the BSE Sensex, managed by the Bombay Stock Exchange also based in Mumbai, jumped 2.5% to reach 81,689.46.

The broader small-cap and mid-cap indices rose even higher, with gains of 3.5% and 3.1%, respectively. The volatility index, known as India VIX or the “fear gauge,” appeared set to break its eight-day upward streak, suggesting a calming of investor nerves.

The truce was reached after India launched retaliatory strikes on May 8, targeting nine sites in Pakistan in response to a militant attack in Kashmir that killed 26 civilians two weeks earlier. The ceasefire was seen as fragile but largely holding by Monday morning.

In a note, Barclays stated, “Assuming the ceasefire is adhered to by both countries, we keep all our macro forecasts unchanged. We see India grow at a solid 6.5% y/y in FY25-26, benefiting from relative insulation to global trade uncertainty and strong progress in trade talks with the US.”

Sector-wise, heavyweight financial stocks gained 3.1%, while the IT sector rose 2.4%. Tourism and travel-related companies, which had suffered the most during the conflict, rebounded by 4%.

The only sector to decline was pharmaceuticals, which dropped 0.7% following an announcement by U.S. President Donald Trump. He said he would issue an executive order to lower prescription drug prices to match those in high-income countries. Major pharma companies like Cipla and Sun Pharmaceutical Industries ended in the red.

Globally, investor sentiment was also lifted by signs of progress in U.S.-China trade talks, helping ease fears of a potential global recession.