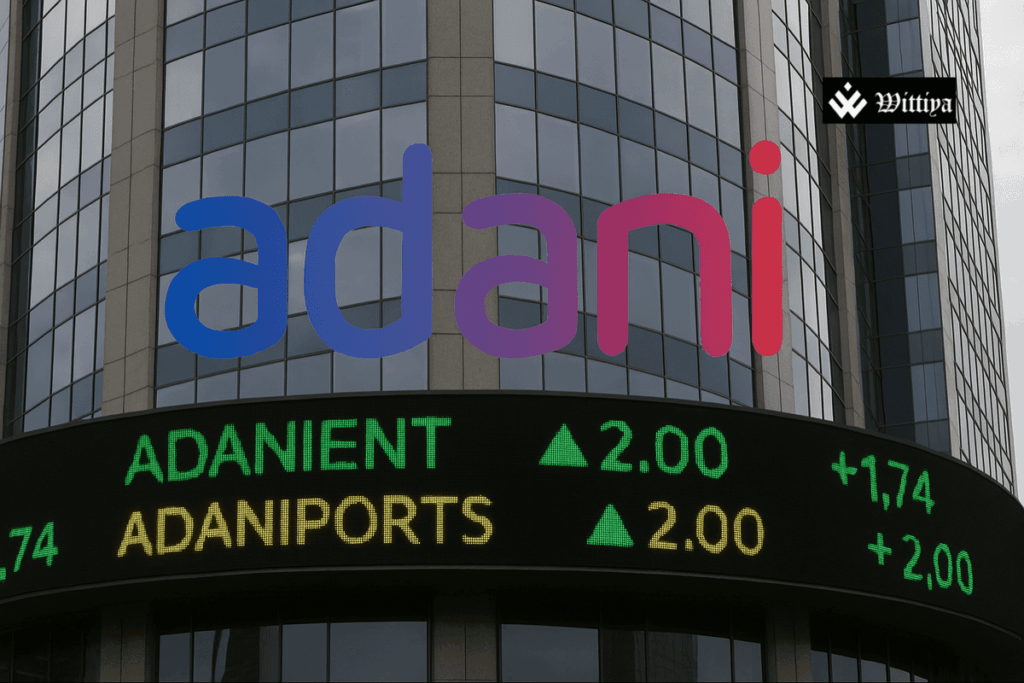

Adani Group stocks, including Adani Enterprises, Adani Green Energy, and Adani Ports, gained up to 2% on May 14, driven by optimism around the US-China trade deal and strong quarterly results.

Adani Group stocks saw a notable rise on May 14, with some shares climbing as much as 2%, fueled by strong market sentiment and optimism surrounding the US-China trade deal. The positive momentum was further bolstered by strong quarterly results reported by the group’s companies.

Adani Enterprises led the gains, with its share price climbing 2% to ₹2,481 apiece. The stock extended its winning streak for the third consecutive day after reporting a massive 756% year-on-year (YoY) increase in consolidated net profit for Q4 FY25, reaching ₹3,845 crore. This was driven by an exceptional gain of ₹3,286 crore from the sale of a 13.5% stake in Adani Wilmar (AWL).

Adani Green Energy also continued its upward trend for the second consecutive session, rising 1.7% to ₹975 per share. The company posted a 24% YoY rise in net profit to ₹383 crore in Q4, while revenue from core operations increased by 21.6% YoY to ₹3,073 crore.

Adani Ports & Special Economic Zone, another key player in the group, saw its share price increase by 1.20%, hitting a day’s high of ₹1,385.90. This rise came after the company reported a strong Q4 FY25 performance, with a 50% YoY surge in consolidated net profit to ₹3,023 crore. Revenue from operations also grew by 23% YoY to ₹8,488 crore, and EBITDA increased by 24% YoY to ₹5,006 crore.

Additionally, AWL Agri Business continued its upward momentum, gaining 2.3% to ₹269.20 per share. The company reported a net profit of ₹191 crore for Q4 FY25, a significant increase from ₹157 crore in Q4 FY24.

These gains come in the wake of a rally that started in early May, spurred by reports that Adani Group representatives met with officials from former U.S. President Donald Trump’s administration to discuss seeking the dismissal of criminal charges in an overseas bribery investigation. The optimism surrounding the US-China trade deal, which is expected to boost global demand for base metals, also contributed to the positive sentiment in the Indian stock market.

About Adani Group:

Adani Group is a diversified conglomerate with operations in sectors such as energy, infrastructure, logistics, and defense. Founded by Indian billionaire Gautam Adani, the group has seen significant growth in recent years, with a focus on sustainability and global expansion.