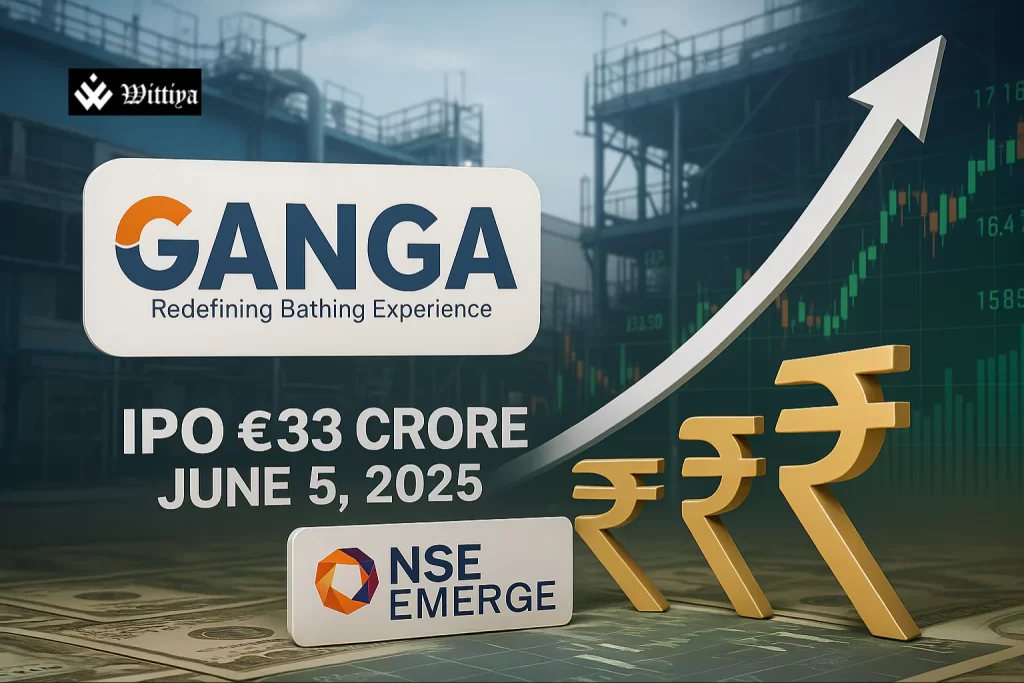

India-based Ganga Bath Fittings, a leading manufacturer of bathroom accessories headquartered in Gujarat, has opened its ₹33 crore IPO for subscription on June 5, 2025. The company aims to utilize the funds for capital expenditure, debt repayment, working capital, and corporate needs. The IPO is fully a fresh issue and will be listed on NSE Emerge.

Ganga Bath Fittings, a prominent Gujarat-based manufacturer of bathroom accessories, launched its Initial Public Offering (IPO) worth ₹33 crore on June 5, 2025. The IPO comprises a fresh issue of 66.63 lakh equity shares and will be listed on NSE Emerge, the SME platform of the National Stock Exchange.

Founded with a vision to provide innovative and durable bathroom solutions, Ganga Bath Fittings aims to utilize the proceeds from the IPO to fund capital expenditure, repay existing debt, meet working capital requirements, and support general corporate purposes.

Investors can subscribe to a minimum of 3,000 equity shares and in multiples thereafter. Jawa Capital Services is serving as the sole book-running lead manager, while KFin Technologies has been appointed as the registrar to the issue.

This IPO will fuel our vision for the future enabling us to invest in modern machinery, improve our manufacturing scale, and strengthen our financial foundation. We see this as a stepping stone to greater innovation and deeper market penetration.”

Jimmy Tusharkumar Tilva, Managing Director

In the financial year 2023–24, the company reported a revenue of ₹31.89 crore and a profit after tax (PAT) of ₹2.48 crore. As of December 2024, revenue stood at ₹32.29 crore with a PAT of ₹4.53 crore, reflecting consistent growth and profitability.

The IPO marks a strategic milestone for Ganga Bath Fittings as it seeks to enhance its market presence and manufacturing capabilities across India.