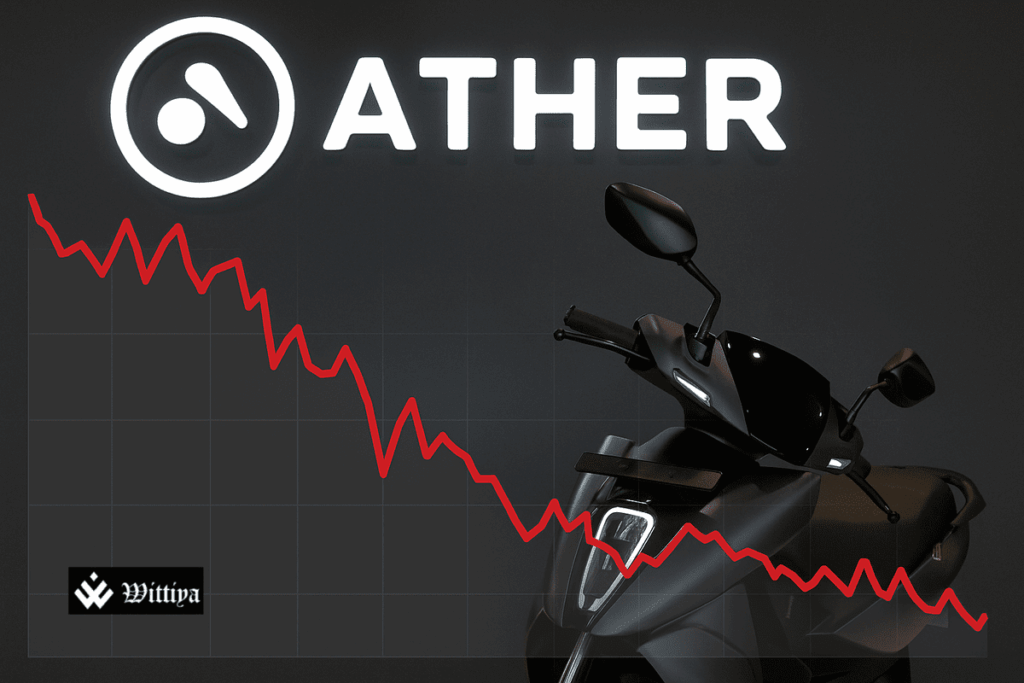

Ather Energy’s share price fell by 6% following its muted debut in the Indian stock market on May 6, 2025. Despite opening at a premium, the stock quickly lost ground, marking a lukewarm start for the electric vehicle company.

Ather Energy, a prominent electric vehicle (EV) manufacturer, made its debut on the Bombay Stock Exchange (BSE) and National Stock Exchange (NSE) today, with its shares opening at a slight premium to its issue price. However, the stock soon saw a sharp decline, falling by 6% from its listing price, signaling a muted reception in the market.

The IPO listing, which had initially opened at ₹326.05 per share on the BSE and ₹328 on the NSE, was in line with analysts’ expectations of a lukewarm debut. While the stock price briefly rose above its issue price of ₹321, it soon began to lose steam, dipping to ₹306.50 on BSE, and trading at ₹307.40 by 12:40 PM, marking a 5.72% decline.

Ather Energy, which holds an 11.5% share of the Indian electric two-wheeler market, is faced with significant competition from well-established players such as Hero MotoCorp, Bajaj Auto, and new entrants like Ola Electric. The company has yet to achieve profitability, and with its market share gains slowing down, investors appear cautious about its growth prospects.

Despite Ather’s early mover advantage in the electric mobility space, experts suggest that the company will need to show significant improvements in its financial performance and production scaling post-listing to gain investor confidence. As the company navigates the highly competitive and capital-intensive EV sector, its future stock performance will largely depend on volume growth and clear profit visibility in the near future.

As of the latest data, Ather Energy shares continue to face volatility, with analysts predicting that high competition and cash burn will drive short to medium-term fluctuations in its stock price.