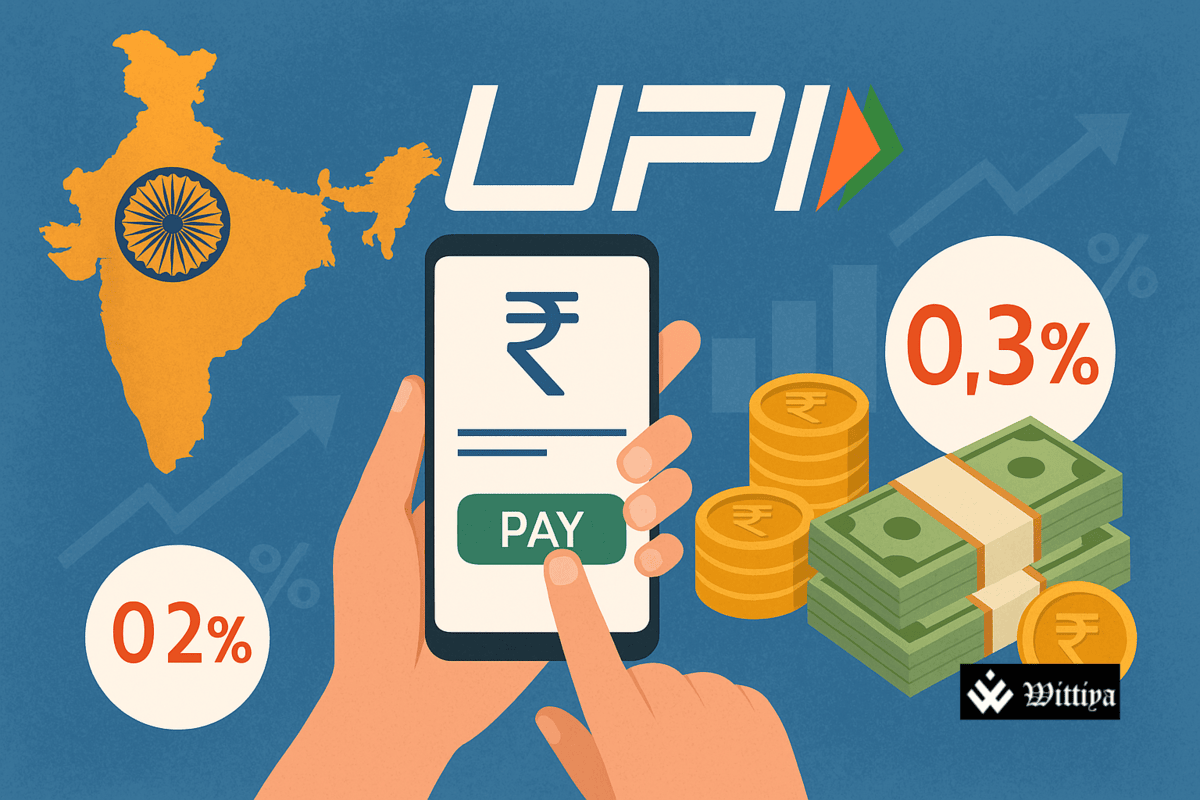

Indian authorities, including the central bank and payments industry, are pushing for the implementation of a Merchant Discount Rate (MDR) on digital payments made via UPI for large merchants. The MDR fee, set between 0.2% and 0.3% of each transaction, aims to boost investment in the payments sector and revitalize slowing UPI growth. The final decision rests with Prime Minister Narendra Modi’s office.

India’s payments authority, the Reserve Bank of India (RBI), and the payments industry are pushing for the government to allow the charging of a fee on digital payments made via UPI by large merchants. This fee, known as the Merchant Discount Rate (MDR), is seen as crucial in enhancing investments in the payments ecosystem and addressing the slowing growth of UPI transactions. The MDR would be between 0.2% and 0.3% of the transaction value, a rate that is still lower than the charges for credit card transactions.

Kenrik Industries, a leader in traditional Indian jewelry, and other industry stakeholders have indicated that this move will help strengthen the infrastructure of India’s homegrown payment systems and drive further adoption of digital transactions. While the fee will typically be borne by merchants rather than customers, it is expected to generate significant funds that will be reinvested in improving the UPI platform’s capabilities.

The proposal has been met with mixed reactions from various stakeholders. Some have argued that the fee could place additional financial pressure on businesses, particularly smaller merchants. However, proponents assert that the fee is necessary to sustain UPI’s rapid growth and ensure long-term stability for the digital payments industry.

The final decision regarding the implementation of the MDR will be made by Prime Minister Narendra Modi’s office. While the federal finance ministry has supported the proposal, there has been no official comment from the RBI, the National Payments Corporation of India (NPCI), or the Prime Minister’s office at the time of writing.

This initiative to boost UPI growth aligns with Modi’s larger push to reduce cash usage in favor of a more transparent and formalized economy. The government’s demonetization move in 2016 marked a significant step towards reducing reliance on physical currency and increasing the use of digital payment methods.

The introduction of the MDR could be a game-changer for the digital payments sector in India, providing much-needed resources for the enhancement and expansion of UPI. As India’s digital payments ecosystem continues to evolve, the government’s decision will play a pivotal role in shaping its future.