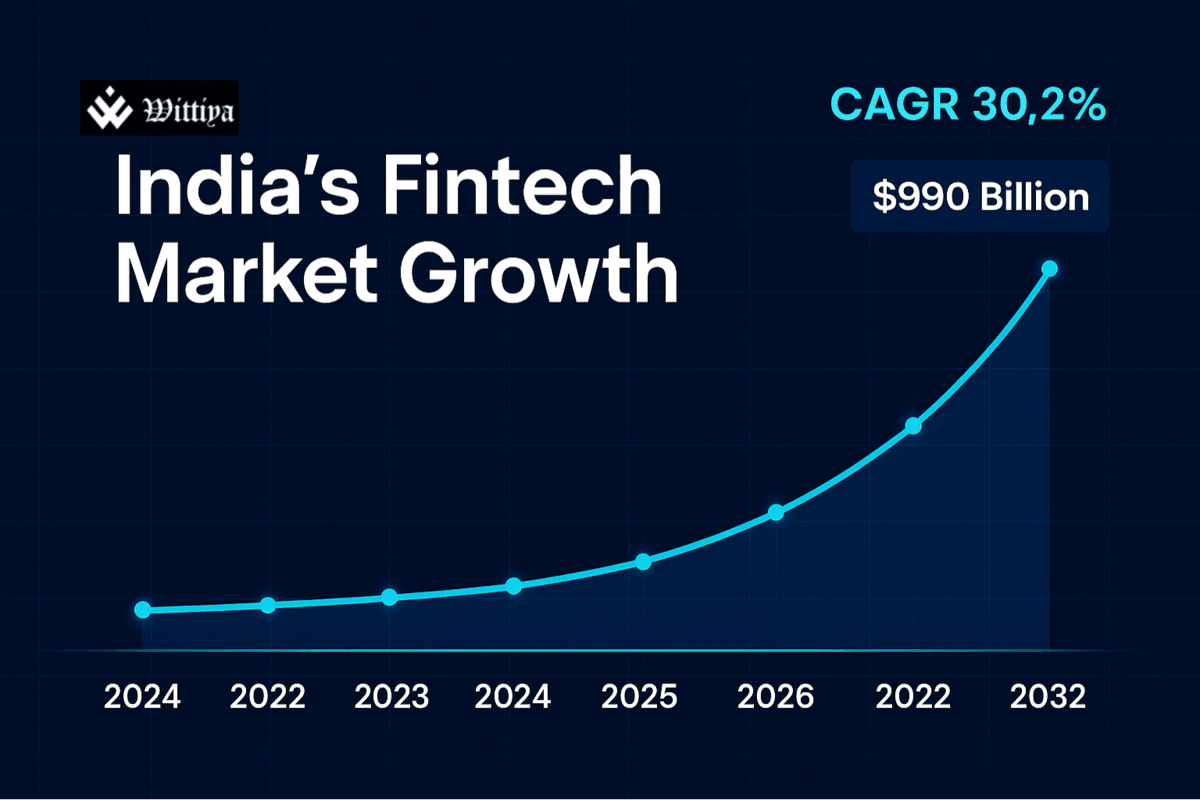

India’s fintech sector is poised for exponential growth, expected to reach $990 billion by 2032 at a CAGR of 30.2%. With strong government support, rising digital payment adoption, and tech-driven lending innovations, the ecosystem is transforming how India accesses and experiences financial services.

India’s fintech sector is undergoing one of the fastest and most dynamic transformations globally. Fueled by the convergence of finance and technology, supportive government policies, and increasing consumer appetite for digital solutions, the Indian fintech market is expected to grow exponentially, reaching a staggering $990 billion valuation by 2032. This represents a robust compound annual growth rate (CAGR) of 30.2% between 2024 and 2032, marking India as a global fintech powerhouse.

A Digital Revolution Reshaping Finance

India has transitioned from a largely cash-driven economy to an increasingly digital-first financial ecosystem. The widespread availability of affordable smartphones, expanding internet penetration, and a youthful, tech-savvy population are accelerating this shift. From contactless payments to digital lending, insurance tech, wealth management, and banking solutions, fintech is radically reshaping how individuals and businesses manage money.

Government initiatives such as Digital India, the launch of Unified Payments Interface (UPI), and Aadhaar-based e-KYC have been pivotal in creating an enabling environment for fintech innovation. The regulatory sandbox established by the Reserve Bank of India (RBI) fosters experimentation and innovation within a secure framework, allowing startups to develop cutting-edge financial products while ensuring compliance and consumer protection.

Key Growth Drivers

- Digital Payments: A Catalyst for Growth

Digital payments remain the backbone of India’s fintech surge. UPI alone processed over 10 billion transactions monthly in 2025, reflecting rapid adoption. Mobile wallets, QR code payments, and contactless cards are increasingly popular, with penetration extending beyond urban centers into semi-urban and rural areas. Government efforts to promote a cashless economy, combined with merchant incentives and consumer convenience, are driving this boom. - Technology-Driven Lending Innovations

Traditional credit scoring often excludes a large segment of India’s population. Fintech lending platforms use alternative data sources—such as mobile phone usage, utility bill payments, and social media behavior—combined with artificial intelligence (AI) and machine learning (ML) algorithms to evaluate creditworthiness. This democratizes access to credit for small business owners, gig workers, and low-income individuals, boosting financial inclusion and entrepreneurship. - AI, ML, and Blockchain Integration

Artificial intelligence and machine learning enable personalized financial advice, risk management, and automated customer support through chatbots and robo-advisors. Blockchain technology enhances security and transparency, particularly in digital identity verification, cross-border payments, and fraud prevention. Together, these technologies are driving efficiency, reducing costs, and building trust within the fintech ecosystem.

Regional Fintech Landscapes

- North India: Delhi NCR, Uttar Pradesh, and Haryana are witnessing rapid fintech adoption due to supportive policies, infrastructure development, and increasing digital literacy. This region is emerging as a key hub for fintech startups focused on lending, payments, and insurance.

- South India: Cities like Bengaluru, Hyderabad, and Chennai benefit from a strong IT ecosystem, top-tier talent, and proximity to leading research institutions. This environment fosters innovation in AI-powered fintech solutions, blockchain applications, and wealth tech.

- West India: Mumbai remains India’s financial nerve center, providing fintech startups access to a deep pool of investors, banks, and regulatory institutions. Gujarat and Rajasthan are also rising fintech hotspots, thanks to expanding digital infrastructure and government-backed initiatives.

Leading Players and Competitive Dynamics

India’s fintech market is highly competitive, with a mix of established giants and innovative startups:

- Paytm: A pioneer in digital wallets and payments, Paytm offers a diverse ecosystem including e-commerce, lending, and wealth management.

- PhonePe: Known for its seamless integration with UPI and merchant platforms, PhonePe continues to expand its user base with innovative payment features.

- Razorpay: Focused on enabling seamless digital payment acceptance for small and medium enterprises (SMEs), Razorpay is a leader in business payments solutions.

- Policybazaar: India’s largest insurance aggregator, providing consumers with comparison tools and personalized insurance recommendations.

- Zerodha: Disrupting online stock trading with a zero-commission brokerage model, Zerodha has transformed the retail investing landscape.

Emerging Trends and Future Outlook

- Mobile-First Financial Services: With India’s internet users primarily accessing services via mobile devices, fintech companies are designing apps and platforms optimized for mobile experiences, including offline and low-bandwidth environments.

- Buy-Now-Pay-Later (BNPL): This credit model is gaining traction among millennials and Gen Z consumers, offering flexible payment options and changing consumption patterns.

- Strategic Partnerships: Collaboration between fintech firms and traditional banks is increasing, blending legacy financial infrastructure with modern, agile technology to enhance product offerings and customer experience.

- Financial Inclusion: By targeting underserved markets—rural populations, women entrepreneurs, and low-income groups—fintech companies are driving greater access to financial services and economic empowerment.

- Regulatory Evolution: Regulators continue to refine frameworks to balance innovation with consumer protection, fostering a safe, transparent, and robust fintech environment.

India’s fintech journey is not just about rapid market growth—it’s about fundamentally transforming financial access and services across the country. As technological innovation accelerates and consumer behavior shifts, fintech firms are poised to drive unprecedented economic inclusion, efficiency, and security. By 2032, India’s fintech market is expected to be among the largest in the world, reflecting the nation’s leap towards a digital financial future.