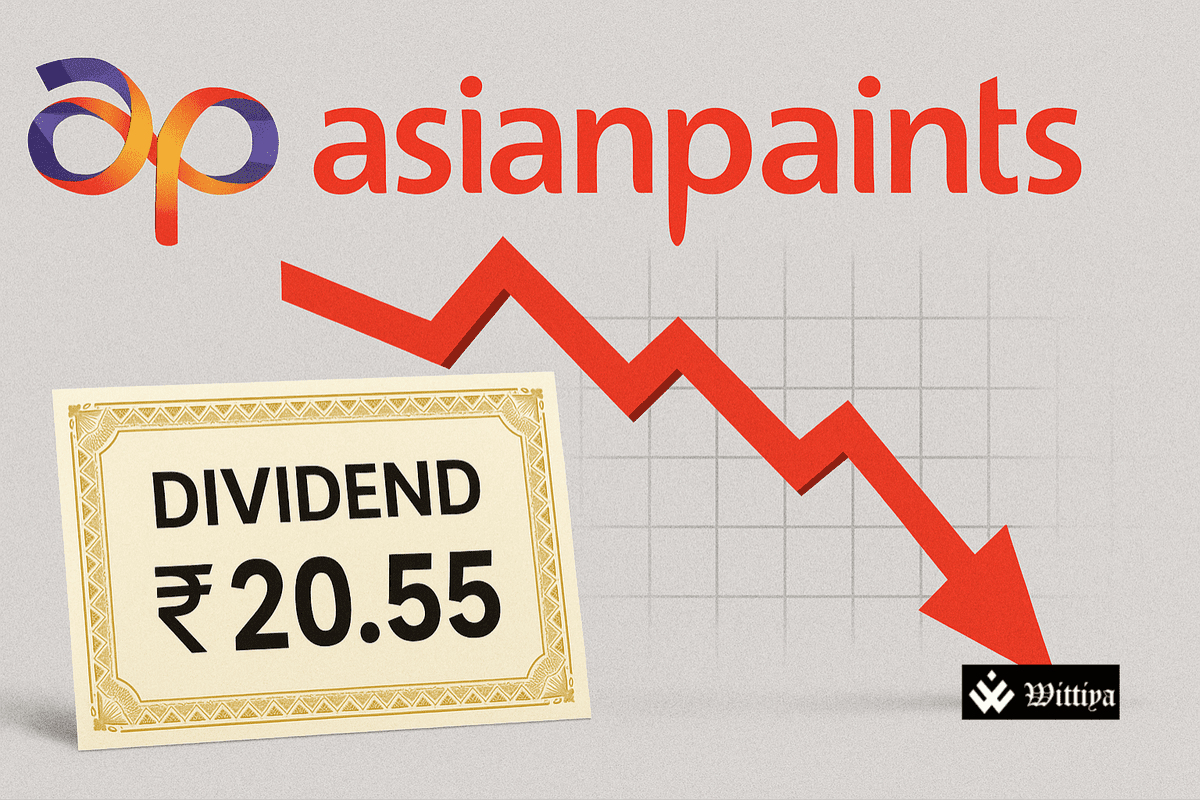

India-based Asian Paints, headquartered in Maharashtra, reported a steep 45% year-on-year drop in net profit to ₹692 crore for Q4 FY25, driven by exceptional losses from overseas divestments and impairments. The company also declared a final dividend of ₹20.55 per share, despite facing subdued consumer demand, muted volume growth, and downtrading across key segments.

Asian Paints Ltd, a leading paints and home décor company in India headquartered in Mumbai, Maharashtra, reported a 45% year-on-year decline in consolidated net profit to ₹692 crore for the quarter ending March 31, 2025 (Q4 FY25). The fall came in sharply below market expectations, impacted by exceptional losses and weak demand conditions.

According to the company’s regulatory filing, the Q4 FY25 results included exceptional items worth ₹182.96 crore, primarily due to a ₹83.7 crore loss on the divestment of its Indonesian subsidiaries and impairment charges linked to its White Teak and Causeway Paints acquisitions.

The decorative paints division, which is a core segment for Asian Paints, reported a modest 1.8% volume growth, but revenue declined 5.2%. The company attributed this performance to “muted consumer sentiment, downtrading, and increased competitive intensity.”

Overall, consolidated revenue dropped 4.3% year-on-year to ₹8,359 crore, missing analyst estimates of ₹8,619 crore. On a standalone basis, revenue declined 5.1% to ₹7,192.4 crore while net profit dropped 42.6% to ₹694.3 crore.

Despite the weak quarter, Asian Paints declared a final dividend of ₹20.55 per equity share for FY25, bringing the total dividend for the year to ₹24.80 per share. The record date is set for June 10, 2025, with a payout scheduled on June 30, 2025.

Also Read: A Paint Industry Revolution: Birla vs. Asian Paints Begins

Paint Industry Disrupted: Birla Opus Challenges Asian Paints’ Dominance

The company’s stock reflected the underwhelming results, trading down by 1% at ₹2,310.7 on the NSE post-announcement.

Segment-wise, the home décor and kitchen businesses struggled due to reduced household spending. The kitchen segment’s revenue fell 15.5% year-on-year to ₹85.1 crore with a PBDIT loss of ₹13 crore. Conversely, the bath fittings segment grew 3.7% to ₹91.9 crore and narrowed its losses.

Industrial coatings showed strong performance, registering a 10.8% increase in sales to ₹347.1 crore. International operations, though impacted by currency issues in Ethiopia and Egypt, posted a 6% growth on a constant currency basis.

Asian Paints’ Managing Director & CEO Amit Syngle commented, “The weak demand conditions prevalent for the past few quarters continued to affect the paint industry even in the last quarter of the financial year.”

As of 2023, the company held a 60% stake in White Teak, now a subsidiary, which contributed to the impairment loss this quarter due to derivative contract-linked fair valuation losses and investments.

Asian Paints is one of India’s largest and most recognized paint companies, operating in over 15 countries with manufacturing facilities across Asia and the Middle East. The company has diversified into home décor, bath fittings, and furniture, in addition to its paint business.