Punjab National Bank, one of India’s largest public sector banks headquartered in New Delhi, posted a 52% rise in net profit in Q4 FY25, declared a ₹2.90 dividend, and approved a fundraising plan of ₹8,000 crore for FY26.

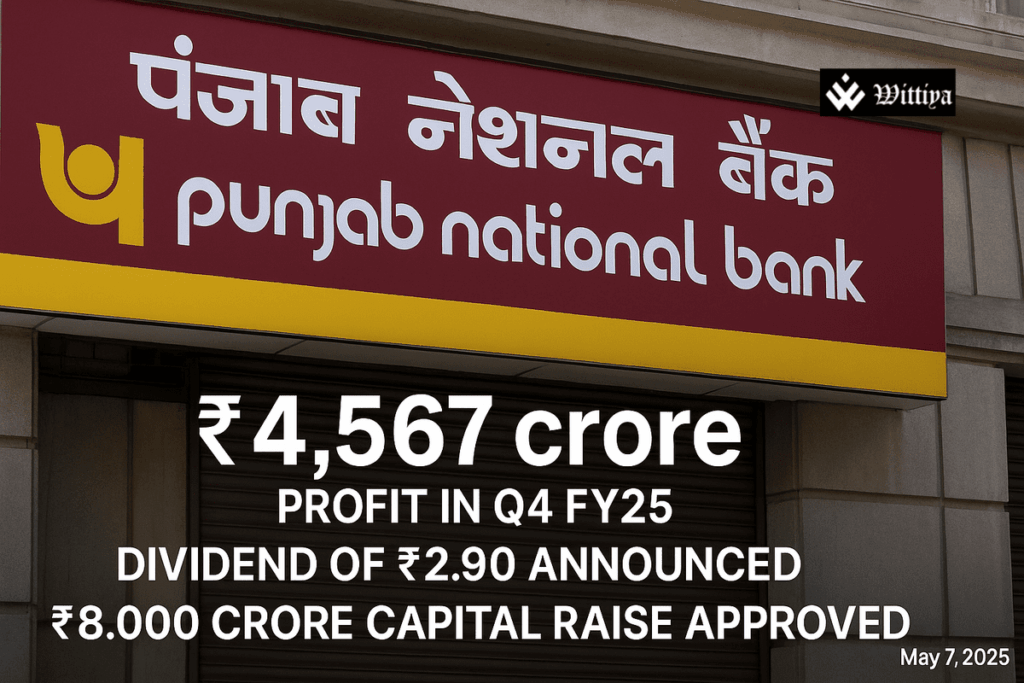

Punjab National Bank (PNB), the third-largest public sector lender in India headquartered in New Delhi, announced its financial results for the fourth quarter of fiscal year 2024–25. The bank reported a 52% year-on-year (YoY) increase in net profit to ₹4,567 crore, compared to ₹3,010 crore in the same quarter last year.

The bank’s net interest income (NII), the core revenue from lending, rose 3.8% YoY to ₹10,757 crore in Q4 FY25. Alongside profit growth, PNB also reported an improvement in asset quality. Gross Non-Performing Assets (GNPA) dropped to ₹44,081.60 crore from ₹45,413.98 crore quarter-on-quarter (QoQ), and the gross NPA ratio improved to 3.95% from 4.09%. Net NPAs also fell to ₹4,290.55 crore, while the net NPA ratio slightly decreased to 0.40%.

PNB’s board has recommended a final dividend of ₹2.90 per equity share for FY25, amounting to 145% of the face value of ₹2 per share. This dividend is subject to shareholder approval at the upcoming Annual General Meeting.

Additionally, the board approved a proposal to raise up to ₹8,000 crore during FY2025–26. This capital will be raised through the issuance of Basel III-compliant bonds, with ₹4,000 crore allotted for Additional Tier-I Bonds and another ₹4,000 crore for Tier-II Bonds, in one or more tranches.

Despite the strong financial performance, PNB’s share price closed 0.58% lower at ₹94.00 on the BSE after the results announcement.